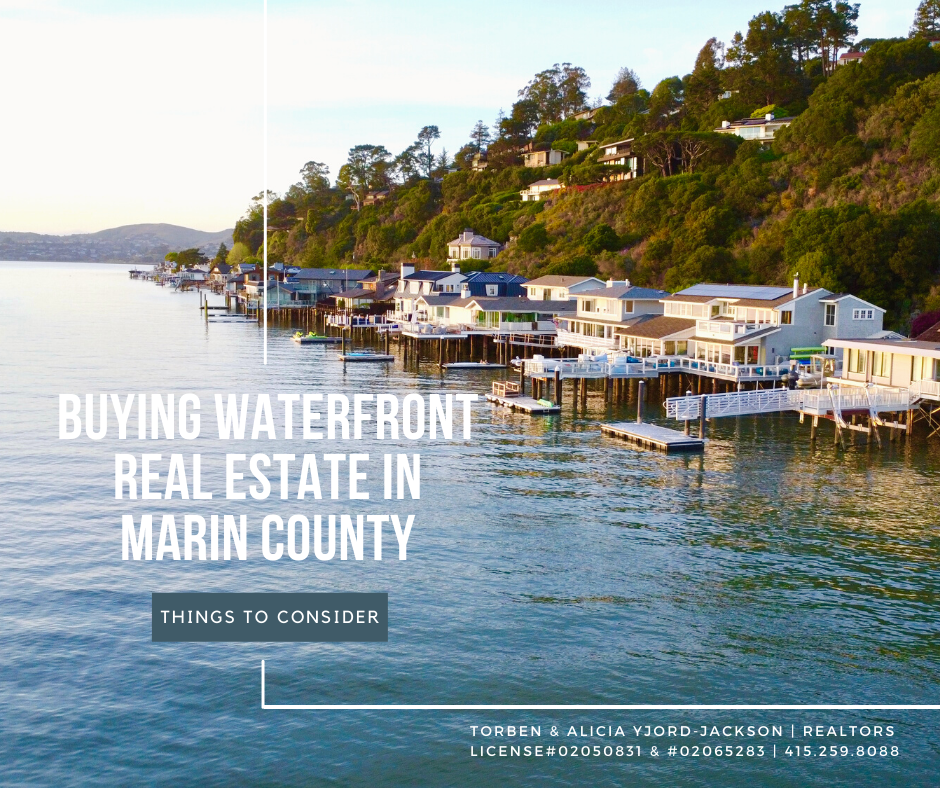

Waterfront real estate is without a doubt the most desirable real estate in Marin County, California. If you are considering buying a waterfront property here on the Bay, you need to make some considerations prior to writing offers, and closing escrow.

-

- Work with a local waterfront real estate specialist: Waterfront real estate has specific complexities that one needs to be aware of to ensure you are buying a solid property that fits your needs. Growing up on the San Francisco Bay in a home with a dock, being active boaters, and regularly representing both buyers and sellers in a waterfront community, Alicia and I know the complexities of waterfront property. Together, we can help you navigate a successful purchase or sale as your Realtors.

- Talk with the neighbors & look for clues of erosion and water intrusion: Alicia and I recently worked with a client on the potential purchase of a home along the waterfront in San Rafael. The sellers were marketing the property as having an abundance of storage in the crawl space off the garage which on paper added great value. When we toured the property, we noticed the crawl space had high water marks that ran right to the slab of the garage floor, and the crawl space/storage area had at one point been 4 feet underwater. We spoke with the neighbors and confirmed that the street floods during king tides, therefore the crawl spaces and some of the garages flood, making the marketed storage area obsolete.

- Check the condition of the foundation, seawall, and dock piers: If the home is built on piers over the water, has a sea wall, or has a dock with piers that lead out into the water, confirm the condition of those piers during your inspection contingency. If repairs are or will be needed, you want to negotiate a credit for repairs upfront, or at least financially plan for this. At times, this can be overwhelming or be beyond the scope of a general inspector or pest inspector, so hiring a qualified engineer to inspect is a good idea.

- Obtain an insurance quote: Waterfront properties have more expensive insurance policies than non-waterfront properties. Check with a local insurance broker to establish what types of coverage you will need, and what that coverage will cost. Oftentimes, waterfront homes will benefit from flood insurance on top of a general hazard and earthquake policy. We have some excellent insurance brokers that we can consult.

- If you plan to make enhancements to the home, find out what you can do to the property: If you envision making enhancements to the property, we need to ensure with local authorities that those changes can be made, what agencies will require involvement, and what requirements you may be up against, especially from an environmental agency standpoint.

- Visit the property a few times, at different times of day or night: Many buyers do not visit a property multiple times prior to writing an offer, or during the due diligence phase. Alicia and I believe that one of the most important steps in really understanding a neighborhood, or the specifics of a home, especially a waterfront home is to see the property at different times of the day.

For example, the floating home communities in Sausalito have navigable waterways during high tide, but at low tide, many of them rest in the mud, and so do the pleasure boats docked to them. The area becomes a mud flat making it so the pleasure boats can only come and go during a higher tide. - Do you plan to keep your boat at the property? Just because a property is on the water does not necessarily mean that you can keep a boat in the water full time. As an example, homes along Mar East Street in Tiburon for the most part do not have traditional floating docks. So, boat owners mostly have boat lifts to store boats out of the water. This is mostly because at low tides, depth is an issue, and the shoreline along Mar East Street is impacted by tidal surges, and waves from wind and boat traffic.

Another example would be the waterfront homes along Corinthian Island. Although these homes have docks that float with the tide, these boat owners mostly choose to move their boats to safe harbors during winter storms. If you are not a member of the San Francisco Yacht Club or Corinthian Yacht Club, you will need to find another safe harbor to bring your boat to during storms, and that could prove difficult unless you maintain a regular slip lease at a local marina.

- When was the area last dredged and what has it traditionally cost? Not all waterfront homes with docks will require dredging, but many do, and this is an expense you want to be aware of, especially if you are a member of a homeowners association. Communities like Strawberry Point and Paradise Cay feel the effects of bay mud infilling into their moorage areas and channels. To maintain adequate depth to ensure that boats can safely come and go without running aground, these channels and dock areas must be periodically dredged. Dredging is not an inexpensive task and it is important to be aware of this added expense, especially if it is a requirement for homeowners per an HOA.

At the end of the day, nothing compares to living life along the water. As long as you are aware, and prepared for some extra maintenance and expenses, the lifestyle can not be beaten. If you are considering buying or selling waterfront property, or any property for that matter, we would love the opportunity to work with you.

_____________________

📲(415) 259-8088

⌨️torben@thriveinmarin.com

💻www.torbenandalicia.com

Torben Yjord-Jackson – Realtor

License # 02050831

Alicia Magdaleno – Realtor

License #02065283

_____________________